SERVICES

Accounting Services

Trademark

Pan Card

GST Registration Consultants

Income Tax Consultants

Need Help

Our Client care managers are on call 24/7 to answer your questions representative or submit a business inquiry online.

+91 9925992507

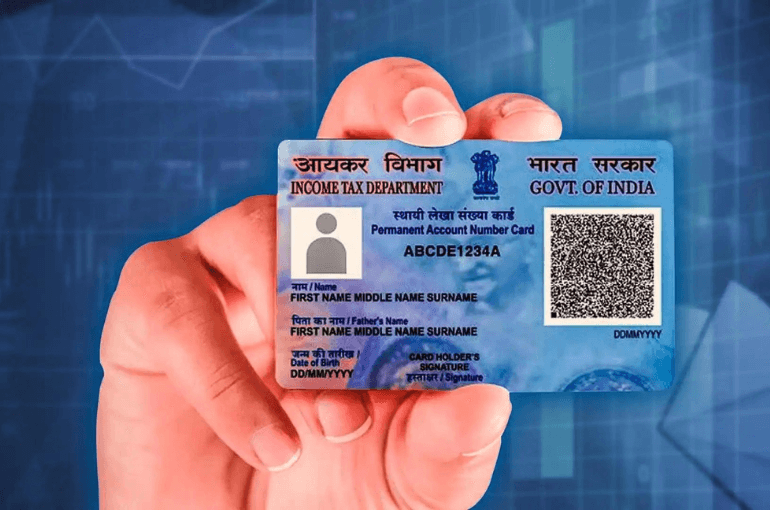

Simplifying Your PAN Card Application Process

At Krishna Associates, we recognize the critical importance of a Permanent Account Number (PAN) card as an essential document for financial transactions and compliance with Indian tax laws. As your trusted PAN card application consultants, we provide smooth and hassle-free services to help individuals and businesses efficiently obtain their PAN cards. With our expertise and commitment to excellence, we aim to make the PAN card application process as simple and straightforward as possible, ensuring full compliance with all regulatory requirements.

Expert Guidance

Our team of seasoned consultants brings extensive knowledge of GST laws and regulations to the table. We stay updated on the latest changes, ensuring your business remains compliant at all times.

Customized Solutions

At Krishna Associates , we recognize that every business is unique. Whether you’re a startup, a small enterprise, or a large corporation, our services are customized to align with your specific business goals.

Comprehensive Services:

Whether you need a new PAN card, need to make corrections or updates to an existing one, or require a reissue of a lost or damaged card, we provide a full range of services to meet your needs. Our consultants manage every step of the PAN card application process, from form filling to submission and follow-up with the authorities, so you don’t have to worry about a thing.

Personalized Assistance:

We understand that each applicant has unique needs and circumstances. Our consultants provide personalized assistance, tailoring our services to your specific situation, ensuring that your PAN card application is managed with the utmost care and attention to detail.

Compliance Assurance:

Ensuring compliance with regulatory requirements is crucial to avoid delays or rejections in the PAN card application process. Our consultants stay up-to-date with the latest regulations and guidelines, ensuring your application meets all necessary criteria, minimizing the risk of errors or discrepancies.

Secure Your PAN Card with Krishna Associates

Whether you are an individual taxpayer, a business owner, or a non-resident Indian (NRI), a PAN card is essential for conducting financial transactions and complying with Indian tax laws. Contact Krishna Associates today to take advantage of our expertise in PAN card services and ensure your application process is handled with efficiency and precision.

Our PAN Card Services Include

- PAN Card Status Tracking

- PAN Card Surrender/Deactivation

- New PAN Card Application

- Correction/Modification of PAN Data

- Reissue of Lost/Damaged PAN Card

- Assistance with PAN Card Verification